straight life annuity death benefit

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Means an annuity for the lifetime of the member only which has not been reduced to provide a lifetime monthly benefit to a spouse or.

Life Annuity Hi Res Stock Photography And Images Alamy

The straight life option pays a monthly annuity directly to the retiree for life.

. No survivor benefit will be. On the death of the retiree the monthly payments. There is typically no death.

What happens to the money in an annuity after the owner dies depends on the type of annuity and its specific provisions. A straight life annuity will benefit single retirees with no heirs the most. Straight Life Annuity.

After 60 payments your benefit is automatically adjusted to your Straight Life Annuity amount. If your death occurs before receiving 60 monthly payments the ASRS will pay the remaining. The key component of this annuity is that it forgoes any further beneficiary payments or a death benefit.

Some annuities stop payments when the owner dies. Also known as a single life annuity pure life annuity lifetime annuity or life. Define Single straight life annuity or maximum benefit.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. However all payments stop at your death. Another term for this option is life-only or single life annuity.

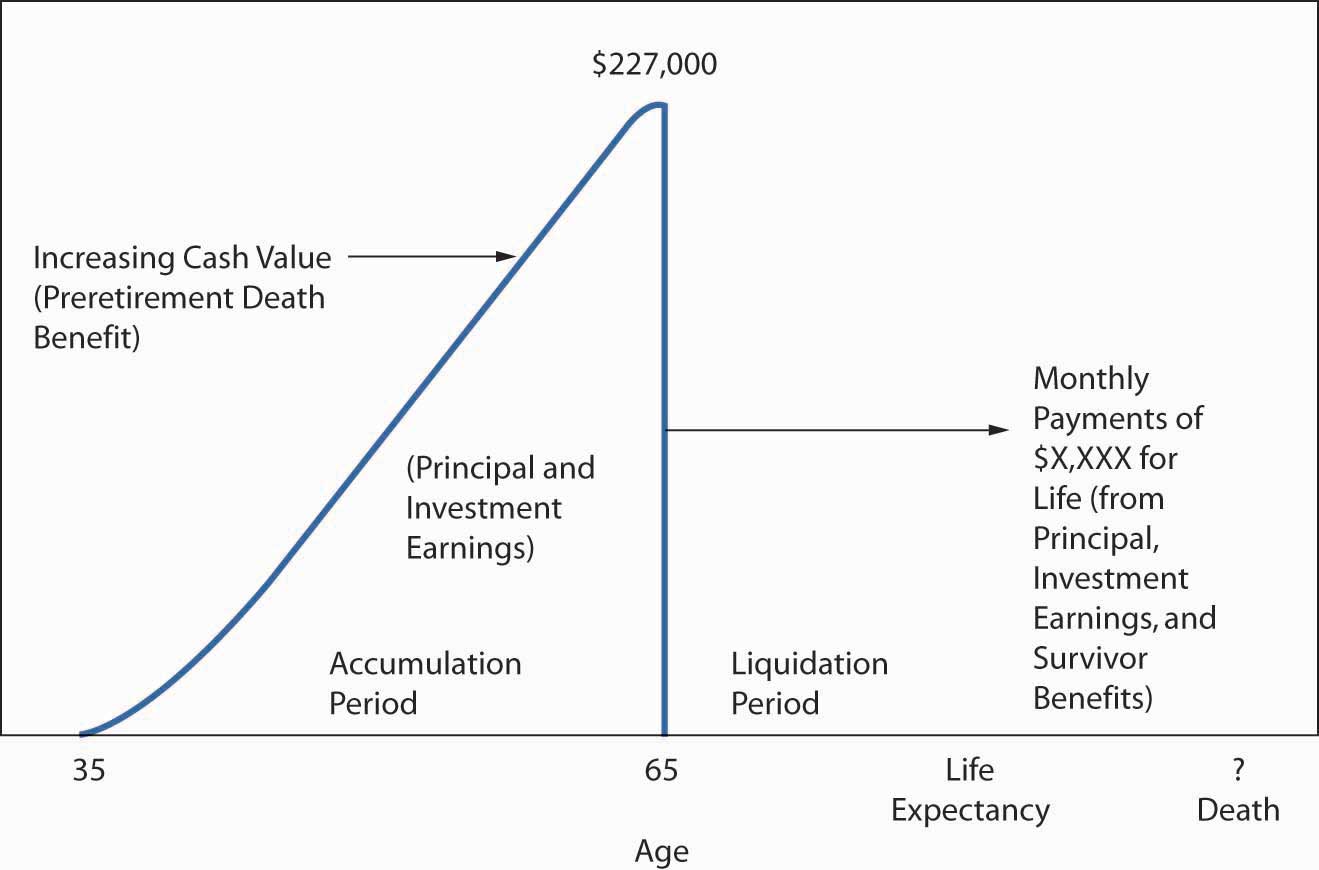

A straight-life annuity that provides you with fixed monthly benefit payments for your lifetime. A straight life annuity will guarantee you a stream of payments throughout your life but those payments end upon death. Straight life annuity is really just a term for an annuitization option that annuities have.

A straight life annuity is a type of annuity in which the annuitant gets payments indefinitely and the payout is greater because the annuity is not required to pay income to a. This option provides you with the highest monthly benefit for your lifetime. Its possible to purchase an.

Keeping in mind that there is an omission of the death benefit Straight Life Annuity is also known as Single Life Annuity as it better serves those who do not have a spouse or heirs. You may elect to receive your benefits in one of the following ways. How Much Does a Straight Life Annuity Cost.

When you annuitize your annuity on a. Straight life is the simplest benefit option offered by APERS. Option D - STRAIGHT LIFE ANNUITY Option D - Straight Life Annuity.

A key benefit of the straight life annuity is that annuitants will receive the highest regular payment for the amount of the lump sum they deposited. Straight Life Annuities or Single Life Annuity distribute annuity payments for a lifetime with no death benefit. These annuities guarantee payments for the rest of the annuitys life and the payouts are greater.

Chapter 5 Annuities Flashcards Quizlet

What Is A Single Life Annuity Due

Mortality Risk Management Individual Life Insurance And Group Life Insurance

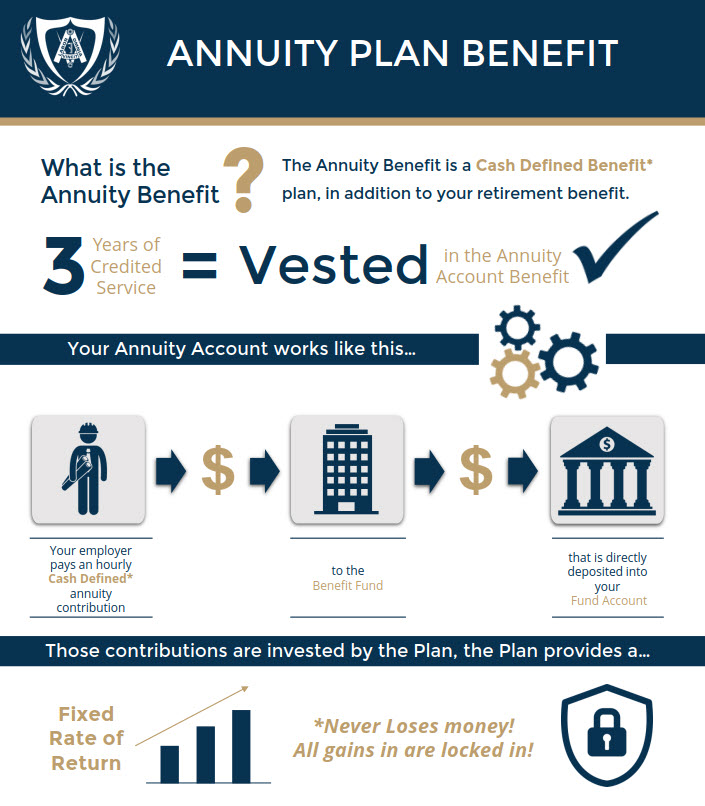

How Annuity Benefits Are Paid Carpenters Benefit Funds Of Philadelphia

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Straight Life Insurance New York Life

Lump Sum Vs Life Annuity For A Pension Payout

What Is A Single Life Annuity Smartasset

Straight Life Annuity What It Is And How It Works 2022

F G Prosperity Elite 7 Annuity Up To 7 Bonus

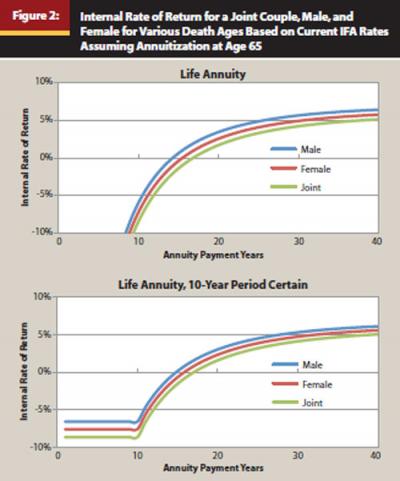

Examining The Benefits Of Immediate Fixed Annuities In Today S Low Rate Climate Financial Planning Association

Tread Carefully With Variable Annuities

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Period Certain Annuity What It Is Benefits And Drawbacks

What Is A Straight Life Annuity Everything You Need To Know

Chapter 15 Not 15 8 Selected Chapter Questions 1 5 Ppt Download